UNATIONAL

International

banking

System Position

UNATIONAL

RASTIN BANKING

Rastin Banking

New Operational banking System

(A bird’s eye view)

Phd/Dr. Bijan Bidabad

BA, MSc, Ph.D, Post Doctorate

Professor Bijan Bidabad (1959)

is a multidisciplinary scientist with effective research, teaching and consulting experiences in different fields of sciences. He has received B.A. in political science (School of Political and Social Sciences, Tehran), and M.Sc. (Shiraz University, Shiraz) and Ph.D. (Islamic Azad University of Iran and Neuchatel University of Switzerland) and Post-Doctorate in economics (WSEAS, Greece) and passed many complementary specialized courses. He has been working in more than 25 different governmental and research institutions in Iran, and has done more than 40 research projects and conducted more than 15 dissertations in different universities. He has written more than 530 articles and books in different fields of sciences and humanities in Persian and English languages. The largest Macro-Econometric Model of Iran, Rastin Banking and proposition of different international declarations and Tabandeh Co-Philanthropy System are of his latest works. He has presented many lectures about his different researches in professional seminars and conferences.

Ph.D. in Economics

1985 – 1989

With cooperation of Neuchatel University, Neuchatel, Switzerland.

- Major: Econometrics.

- Minor: International Economics.

- Scores average: 18 out of 20.

- Prima distinguished graduate.

- Full four years scholarship.

Introduction :

Many economists around the world have done their best to eliminate Riba from banking activities, but have not achieved much. In this direction, Rastin Banking, in compliance with Shar ia commands, has been compiled not to only eliminate Riba , but also to institutionalize various teachings of justice and Islamic ethics in banking activities. Good points of Rastin Banking in all fields of banking, financial, economic, ethical, social and international activities are so expanded that it can be regarded as a bass to improve banking structure.

To increase the compliance of banking system with principles and regulations of Islamic religion, and better access to safe financial activity and helping the economy to bloom, fare distribution of possibilities and opportunities, job creation and increasing the welfare of the society, the Rastin Banking System was designed and all banks can carry out their activities on this basis.

Rastin Banking System is based on special operational, financial, economic, ethical, social, legal, international and organizational principles that based upon the latest scientific achievements of humankind in the field of science and technology with the aim of growth and development of the economy and banking of the society.

To facilitate legal activities of Rastin Banking, some improvements have been carried out on auxiliary Islamic contracts. To fulfill the necessary legislative needs of bank sharing activities, joint investment funds and facilitating social insurance activities some new legal institutions are also defined as “Fund with variable capital”. To distinguish profit from Riba certain measures were also defined.

To prevent squandering ( Israf ) and to reform banking sources consumptions, which have worse economic and social consequences than Riba , and to increase efficiency, bank is obliged to follow specific regulations concerning its activities and finance only those projects, which have observed certain considerations and criteria in their project proposal.

Bank can finance projects of restoring uncultivated lands by supporting qualified applicants for promotion of employment and development of agriculture, industry, mining, housing and tourism in development of different regions of the country.

Bank and parties involved in Rastin Banking contracts should observe the supervisory compiled regulations concerning financial transparency, information disclosure and corporate governance. All contracts with bank are considered as official documents and enforceable. These contracts will be carried out by unit of execution of enforceable documents in bank.

Rastin PLS Banking:

In Rastin PLS banking as the main subsection of Rastin Banking, on behalf of depositor, bank finances entrepreneur for investment according to compiled regulations and at the end project, entrepreneur will distribute the profit/loss of the project in proportion to capital and duration of using that capital with the depositor

Rastin PLS Banking:

In Rastin PLS banking as the main subsection of Rastin Banking, on behalf of depositor, bank finances entrepreneur for investment according to compiled regulations and at the end project, entrepreneur will distribute the profit/loss of the project in proportion to capital and duration of using that capital with the depositor

Rastin PLS Base System:

Rastin PLS Base system refers to the main process and general regulations of Rastin Profit and Loss Sharing (PLS) Banking system. On request and on behalf of depositor, bank invests his fund in one of Rastin PLS products and instead, gives Rastin Certificate of the selected project to him and allocates his fund to selected project of entrepreneur; and supervises the implementation and execution of project. At the end, after deducting its own commission, bank divides the profit/loss (if any) among engaged sides (depositors and entrepreneur). Bank is agent of depositor, and is responsible for observing his rights (depositor). He must use all his expertise to reach this end.

Fixed profit rate is eliminated in Rastin PLS banking and return rate is calculated according to the real return of capital in real economy. Most of the regulations of Rastin PLS Base system are extended to its financial subsystems. This system has its own organization, structure and working process.

Rastin PLS Financial Subsystems:

Rastin PLS financial subsystems refer to specific financing methods or services in Rastin PLS Banking. These subsystems work under general regulations of Rastin PLS Base system:

1. Joalah Financial Sharing (JFS): is a method in which, bank finances entrepreneur (producer) from depositor’s resources or the provided sources by buyer.

2. Mudarabah Financial Sharing (MFS): is a kind of mudarabah under Rastin PLS banking in which bank introduces the entrepreneur project proposal in the field of trade or transaction of commodities (commerce) to depositors.

3. Installment Financial Sharing (IFS): in IFS, installer (depositor) will finance a portion of the needed fund of entrepreneur through the bank for a certain period of time (amortization period). The entrepreneur will pay back his share by installments and will own the total property of the project and IFS ends.

4. Rent Financial Sharing (RFS): entrepreneur temporarily donates the ownership of a part of his productive asset (assets of an operating firm), rental asset (those assets, which can be let) or dead asset (non-operating or suspended firms or uncultivated lands assets) to depositor who finances him but keeps it as mortgage. Then pays back the fund received from the yields of the asset proportional to depositor’s share to depositor at the end of contract, or periodically. The original deposit of depositor will be given back to him after the end of project. The profit of the project will be given to depositor periodically or in a lump.

5. Bail Financial Sharing (BFS): is the application of deposit of depositor by entrepreneur to produce a defined commodity and delivering the commodity or paying back its value in future specific time.

6. Rastin Personal Security (RPS): to create competitive conditions and to increase the efficiency of social security insurance and diminishing antitrust of social security systems and pension funds, private and public pension funds are established according to Rastin Banking regulations. People and firms can allocate a portion of their obligatory (or optional) insurance premium payments (for himself or his employees) for social security to the funds that operate under Rastin Personal Security (RPS) and enjoy its benefits. Therefore, they will be exempted from obligatory insurance premium payments equal to the payment they have paid to these funds.

7. Rastin Social Takaful (RST): benevolent people can deposit their funds at banks for charity purposes, and bank will be allowed to pay profit (or the principal as well) of deposit to needy people, in form of loan or non-returnable payments (according to the depositor request).

8. Rastin Swap Bond (RSB): is based upon Mubadalah (swap) contract between Mobadil (swa.per) and Motebadil (swapee) in which the durations and substances of swaps are equal for first and second swaps. Mot eb adil (swapee) issues the bond and owes to Mobadil equal to the nominal value of bond; and should pay this amount ( badal ) to Mobadil (swaper) at maturity. The issuer ( Moteb adil ) is obliged to give the mobaadal for the same amount and period as badal to mobad il . He can choose a combination of amount and period that the multiplication of amount by period of mobaddal be equal to that of badal . At second maturity, mobadil is committed to return mobaddal to motebadil . No interest rate is involved in these bonds and they are of four kinds: Central Bank Rastin Swap Bond, Treasury Rastin Swap Bond, Bank Rastin Swap Bond, and Commercial Rastin Swap Bond. They can be in domestic money or foreign exchange.

Rastin Certificates:

Rastin Certificates are collection of designed certificates in Rastin PLS Banking Base system and its financial subsystems. These certificates can be anonymous or named papers, which are transferable and negotiable online through the website of bank and are issued with a nominal price and for a certain period. The owners of these certificates share the results of the project proportional to nominal price and participation period of certificate.

Various Rastin Certificates and their characteristics according to the kind of participation in the PLS Base system or its financial subsystems regarding the type of project and the asset used as:

• PLS Base: M usharakah (Participation) and Pazir eh (Subscripted) Certificates.

• JFS: Future Certificate.

• MFS: Mudarabah and Periodic Mudarabah Certificates.

• IFS: Ordinary M ughasatah (installement), Rental Mughasatah and Musharaka Mughasatah

Certificates.

• RFS: Mortgage Sharing, Periodic Mortgage Sharing, Mortgage Mudarabah (commerce), Periodic Mortgage Mudarabah , Mortgage Muz ar aah (cultivating), Periodic Muz araah , Mortgage Mugharasah (planting), Periodic Mortgage Mugharasah , Mortgage Musaghah

(irrigation), Periodic Mortgage Musaghah , Mortgage Istisna (industrial/manufacturing), Periodic Mortgage I sti sna and Rental Certificates.

• BFS: Bail Certificate.

• RPS: Social Security, Personal Security and Pension Security Certificates.

• RST: Takaful and Loan Certificates.

Complementary Systems:

Complementary systems of Rastin Banking refer to innovations, platforms and supplementary Rastin Banking methods and include the following systems:

1- Rastin Certificate Market (RCM): is a web-based settlement system for transaction of interestfree Rastin Certificates and Rastin Swap Bond in Rastin PLS bank.

2- Operation Control and Monitoring System (OCM): is a computerized web-based system that provides the possibility of online inspection and control of bank personnel activities.

3- Mortgage Securitization System (MSS): this system facilitates people to change their assets into Guarantee Certificates through the bank.

More Details Click Here

In Rastin PLS banking as the main subsection of Rastin Banking, on behalf of depositor, bank finances entrepreneur for investment according to compiled regulations and at the end project, entrepreneur will distribute the profit/loss of the project in proportion to capital and duration of using that capital with the depositor

I am item content. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am item content. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am item content. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am item content. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

I am item content. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

three steps to success

We Will Help You Every Project Of The World

Lorem ipsum dolor sit amet, cotns ctetur all of the adicing elit, sed do eiusmod tempor ale dunt ut labore et dolore magna aliqua Mauris amet.

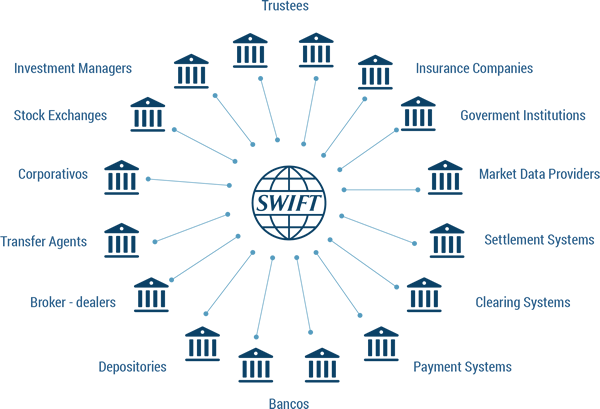

About SWIFT

Society for Worldwide Interbank Financial Telecommunication

SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a global member-owned cooperative that functions as a huge messaging system. Members (banks and other financial institutions) use it to quickly, accurately, and securely send and receive information, primarily money transfer instructions.

Key Takeaways

- Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a member-owned cooperative that provides safe and secure financial transactions for its members.

- This payment network allows individuals and businesses to take electronic or card payments even if the customer or vendor uses a different bank than the payee.

- SWIFT is the largest and most streamlined method for international payments and settlements.

- SWIFT works by assigning each member institution a unique ID code (a BIC number) that identifies the bank name and the country, city, and branch.

- SWIFT has been used to impose economic sanctions on Iran, Russia, and Belarus.